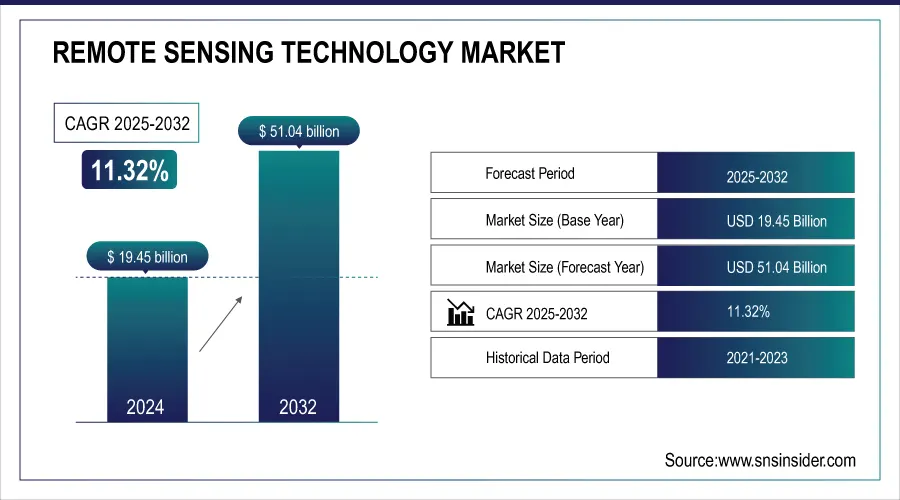

Remote Sensing Technology Market Size & Growth:

The Remote Sensing Technology Market size was valued at USD 19.45 billion in 2023 and is expected to grow to USD 51.04 billion by 2032 and grow at a CAGR of 11.32% over the forecast period of 2024-2032.

This market's growth is driven by increasing adoption rates across regions, with significant investments and funding from both private and public sectors, especially in defense, agriculture, and environmental monitoring. Geospatial data production is expanding rapidly as more satellites and sensors are deployed globally.

To get more information on Remote Sensing Technology Market - Request Free Sample Report

Additionally, innovations in remote sensing technologies and the rising demand for real-time data analytics are propelling market advancements, making it a crucial tool for governments, businesses, and industries aiming to enhance operational efficiency and decision-making capabilities.

Key Remote Sensing Technology Market Trends

-

Rising integration of AI and machine learning for automated image analysis and predictive modeling.

-

Expansion of small satellite constellations and CubeSats to provide cost-effective, high-frequency earth observation data.

-

Growing adoption of hyperspectral and multispectral imaging across agriculture, mining, defense, and environmental monitoring.

-

Shift toward cloud-based geospatial platforms for scalable data processing and real-time accessibility.

-

Increased investment in defense and homeland security applications such as surveillance, reconnaissance, and border monitoring.

-

Strong demand for climate and environmental monitoring solutions to support sustainability and disaster management.

Remote Sensing Technology Market Growth Drivers

-

AI and Big Data Transform Remote Sensing Revolutionizing Agriculture, Forestry, and Environmental Monitoring

The integration of AI and big data analytics is revolutionizing remote sensing technology by enhancing data processing, enabling real-time decision-making, and driving predictive analysis. Industries such as agriculture are increasingly using AI and remote sensing to simulate crop production scenarios and improve yield forecasting, marking a significant shift toward precision management. AI is also enhancing environmental monitoring by enabling applications like real-time tree sorting and ecosystem analysis. This convergence of AI with remote sensing technology is transforming sectors from agriculture to environmental conservation, driving innovation and boosting efficiency. The upcoming democratization of embedded analytics in 2025 is set to further amplify AI’s impact on these advancements. Nearly all (97%) industry leaders believe generative AI will be a game-changer for their companies, with 44% already making substantial investments. In the forestry sector, satellite-based harvest detection and digital photogrammetry are enabling scalable, real-time monitoring of planted forests. This technology holds particular value in New Zealand, where 1.8 million hectares of radiata pine forests play a crucial role in the country’s emission trading scheme and the pursuit of net-zero emissions by 2050. Similarly, in South Australia, 40,000 hectares of plantation estates contribute to a USD 3 billion industry, employing 18,000 people and benefiting local economies in construction, manufacturing, and tourism.

Remote Sensing Technology Market Restraints

-

The remote sensing technology market faces data overload. Vast data from satellite systems requires advanced analytics tools, and without proper infrastructure, inefficiencies hinder decision-making and adoption.

Remote sensing technologies, particularly satellite-based systems, generate massive volumes of data, which can be difficult to manage and analyze efficiently. Without advanced data management systems and analytics tools, the sheer scale of this data can lead to significant inefficiencies, slowing down decision-making and increasing operational costs. Processing and storing such large datasets require substantial computational resources, which may not be accessible to all organizations, especially those in developing regions. Additionally, the inability to extract actionable insights from vast amounts of data hampers the widespread adoption and potential of remote sensing technologies across industries like agriculture, forestry, and environmental monitoring.

Remote Sensing Technology Market Opportunities

-

Satellite Advancements Driving Growth in Remote Sensing Technology

The ongoing advancements in satellite technology, such as the development of smaller, more affordable satellites, are opening new opportunities in the remote sensing technology market. With improved capabilities and reduced costs, these innovations are making remote sensing data more accessible, fueling growth across industries like agriculture, environmental monitoring, and urban planning. Notable projects, such as Iran’s Navak micro-satellite launch and the EU’s secure satellite communication initiatives, showcase the potential for more precise, real-time data collection. As satellite technology evolves, the increased availability of high-quality satellite data will enhance applications ranging from climate monitoring to smart city development.

Remote Sensing Technology Market Challenges:

-

Integration of Diverse Data Sources as a Key Challenge in Remote Sensing Technology Market

The integration of diverse data sources in remote sensing technology presents a significant challenge, as it involves combining data from various sensors, satellites, and platforms with differing formats and standards. These datasets, including optical, radar, and LiDAR data, must be harmonized to create accurate, comprehensive models. This process requires sophisticated software tools and expertise in data fusion to ensure seamless integration, accurate interpretation, and effective utilization. The complexity increases when data is sourced from different geographical regions, requiring custom solutions to manage inconsistencies in data quality and resolution. Furthermore, real-time data integration demands high computational resources and efficient algorithms, which can be resource-intensive and expensive for organizations, particularly in developing regions.

Remote Sensing Technology Market Segment Analysis:

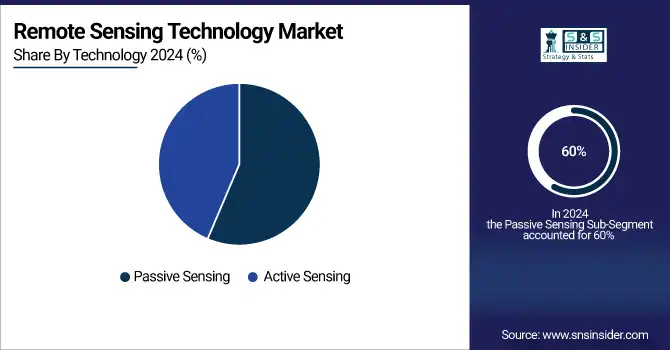

By Technology

In 2024, the Passive Sensing segment captured the largest share of the remote sensing technology market, accounting for approximately 60% of the total revenue. Passive sensing systems utilize naturally available energy sources (for example, sunlight) to collect and measure environmental data. Such systems are widely used in satellite imaging, where they rely on the capture of either reflected light or thermal radiation emitted from bodies on the Earths surface. Passive sensing is gaining popularity due to its low cost, wide range of applications and high-resolution images for various industries, including agriculture, forestry and environmental monitoring. The growing adoption of passive sensing technologies is expected to continue to play a pivotal role in advancing remote sensing capabilities globally.

The Active Sensing segment is projected to be the fastest-growing segment in the remote sensing technology market from 2024 to 2032. This growth is driven progress in radar and lidar technology actively spraying signals and measuring how the signals bounce back in such a way that you get very precise data even in such challenging environmental conditions as cloud cover or low-light scenarios. Active sensing, capable of capturing accurate temporal data, finds its application in diverse fields ranging from land mapping to environmental monitoring and disaster management. Thus the increasing need for accurate, real-time information for applications such as agriculture, urban planning, and defense is anticipated to further propel the demand for active sensing technologies across the globe during the forecast period.

By Platform

The Aerial Systems segment dominated the remote sensing technology market with the largest share of revenue, accounting for approximately 70% in 2024. Due to the increasing adoption of drones and UAVs in a wide range of industries, including agriculture, environmental monitoring, and defense. Drones offer high-resolution images, real-time data collection and flexibility to reach remote or hard-to-access environments, which makes them suited for applications such as crop monitoring, disaster response, surveillance, and infrastructure inspection.As technological advancements enhance the capabilities of aerial systems, their adoption continues to grow, driving further expansion of this segment in the remote sensing market.

The Satellite segment is expected to be the fastest-growing in the remote sensing technology market from 2024 to 2032. This segment signified a notable demand for high resolution imagery, global extent coverage, as well as the ability to monitor large-scale areas instantaneously, which are all major factors that are expected to increase this segment. Remote sensing applications using satellites are done in various forms in agriculture, environmental studies, climate change and disaster management with continuous improvements in satellite capabilities, the market for satellite-based remote sensing is poised for significant expansion during the forecast period.

By Application

The Military & Intelligence segment dominated the largest share of the remote sensing technology market, accounting for around 40% of revenue in 2024, due to an increased reliance on remote sensing technologies for strategic defense, surveillance, and intelligence purposes. Satellites, drones and aerial systems among others through remote sensing technologies are providing real-time imaging, monitoring and data collection capabilities that are essential for national security operations. Military and intelligence agencies use these technologies for border surveillance, tracking enemy movements, reconnaissance, and reconnaissance during conflicts. With increasing geopolitical tensions as well as improvements in sensor technologies, which would continue propelling significant growth in this sector, as more advanced analytics combined with higher resolution data, improved security features, and more sophisticated strategies stand to help Defence strategies and operations all over the world.

The Disaster Management segment is expected to be the fastest-growing in the remote sensing technology market during the forecast period from 2025 to 2032. This growth is due to the rising demand for real-time data for analyzing and managing natural disasters, such as earthquakes, floods, wildfires, and hurricanes. Satellite imagery, aerial systems, and other remote-sensing technologies offer relevant data to monitor disasters, assess risks, and improve response coordination. They assist agencies and organizations in predicting, tracking and assessing disasters, allowing for greater emergency response planning.

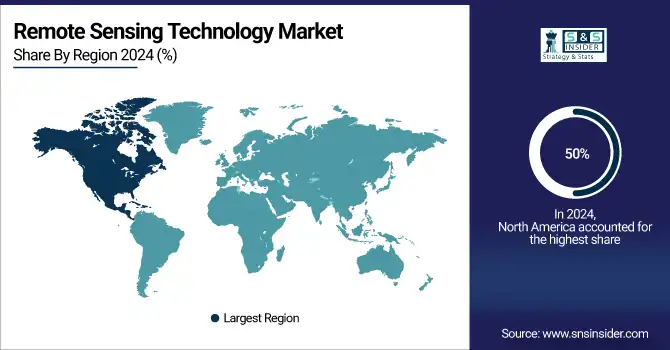

Remote Sensing Technology Market Regional Analysis

North America Remote Sensing Technology Market Insights

In 2024, North America held the largest market share of around 50% in the remote sensing technology market. The region's dominance can be attributed to the to the presence of major players, huge investments in space and defense technologies, and advanced satellite-based remote sensing systems in the region. R&D activities are focused alongside active and passive remote sensing technologies and are predominantly in North America (mainly the United States). The region's increasing need for remote sensing solutions in various industries such as agriculture, environmental monitoring, and defense also contributed to its market share. The region maintains its prominence in the global marketplace due to heavy government funding and public-private partnerships.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Remote Sensing Technology Market Insights

The Asia Pacific region is expected to be the fastest-growing market in remote sensing technology from 2025 to 2032. This growth is driven by rapid industrialization, growing investments in space technologies, and cross-industry embrace of remote sensing solutions in sectors like agriculture, environmental monitoring, and disaster management. Other countries, including China, India, Japan, and South Korea, have made major investments in satellite infrastructure and data analytics capabilities to improve monitoring and predictive analysis for agriculture, urban planning, and natural resource management. Additionally, the increasing focus of government bodies on enhancing environmental preservation measures and disaster management capability in the area is boosting the uptake of advanced remote sensing technologies. The region’s growing economy and technological capabilities will further drive the adoption of these technologies.

Europe Remote Sensing Technology Market Insights

In Europe, the remote sensing technology market held a 26.5% share in 2024, with Germany emerging as the regional leader due to strong government investments in defense, climate monitoring, and precision agriculture. Germany’s focus on integrating satellite imaging with AI-driven geospatial analytics has strengthened its applications in urban planning and environmental monitoring. Meanwhile, the broader European market benefits from EU-led space programs such as Copernicus and Horizon Europe, which support sustainable development and digital transformation.

U.S. Remote Sensing Technology Market Insights

The United States, accounting for 31.2% of the global market in 2024, remains the largest single-country market, driven by defense spending, NASA-led space programs, and private sector innovations from players like Maxar, Planet Labs, and Northrop Grumman. The U.S. market continues to lead in satellite surveillance, geospatial intelligence, and drone-based sensing, ensuring a dominant global position.

Latin America (LATAM) & Middle East & Africa (MEA) Remote Sensing Technology Market Insights

Latin America (LATAM) captured a modest 6.8% share in 2024, with Brazil and Mexico spearheading growth due to increasing adoption of remote sensing in agriculture, forestry, and disaster management. The Middle East & Africa (MEA) accounted for around 9.5% market share, with GCC countries investing heavily in satellite imaging for defense, urban planning, and oil exploration, while African nations are adopting remote sensing for climate resilience, resource mapping, and food security programs. Together, LATAM and MEA represent fast-emerging regions where infrastructure expansion and growing partnerships with global satellite providers are expected to accelerate adoption over the coming years

Remote Sensing Technology Market Competitive Landscape

Maxar Intelligence

Maxar Intelligence is a leading U.S.-based provider of earth imaging and geospatial intelligence solutions, specializing in satellite services and radar technologies.

- In November 2024, Maxar Intelligence sold its Radar and Sensor Technology (RST) group to ARKA Group, a Danbury, Connecticut-based government contractor. This strategic move strengthened ARKA’s synthetic aperture radar (SAR) and geospatial intelligence capabilities while enabling Maxar to focus more closely on SAR advancements through its partnership with Umbra.

Northrop Grumman Corporation

Northrop Grumman is a global aerospace and defense technology leader, delivering advanced systems in space, defense, and security, with strong expertise in radar and satellite protection technologies.

- In January 2024, Northrop Grumman, together with the AUKUS alliance, unveiled the Deep Space Advanced Radar Capability (DARC). This next-generation system enhances space surveillance and satellite protection in geosynchronous orbit, offering 24/7, weather-resilient coverage via a global network of advanced ground-based sensors, marking a major breakthrough in satellite defense.

Remote Sensing Technology Market Key Players

Some of the major players in Remote Sensing Technology Market along with their product:

-

Maxar Technologies (USA) (Earth Imaging, Satellite Services)

-

Esri (USA) (Geospatial Software, GIS Solutions)

-

General Dynamics Mission Systems, Inc. (USA) (Military Communication Systems, Remote Sensing Systems)

-

Hexagon AB (Sweden) (Geospatial Solutions, 3D Mapping, Remote Sensing Software)

-

Lockheed Martin Corporation (USA) (Defense Systems, Aerospace, Satellite Systems)

-

Orbital Insight (USA) (Geospatial Analytics, Remote Sensing Software)

-

Planet Labs PBC (USA) (Satellite Imagery, Earth Observation Data)

-

Northrop Grumman Corporation (USA) (Aerospace, Defense Systems, Space Systems)

-

General Dynamics Corp. (USA) (Defense & Aerospace Solutions, Remote Sensing Technologies)

-

Raytheon Corporation (USA) (Defense Systems, Satellite Solutions, Remote Sensing Systems)

-

Honeywell Technology Solutions Inc. (USA) (Aerospace, Satellite, Remote Sensing Technology)

-

ITT Corp. (USA) (Defense, Communication, Satellite Solutions)

-

Lumasense Technologies, Inc. (USA) (Environmental Sensors, Thermal Imaging)

-

Thales Group (France) (Defense Systems, Aerospace, Remote Sensing Solutions)

-

Leica Geosystems Holdings AG (Switzerland) (Surveying Instruments, 3D Scanning, Remote Sensing)

-

DigitalGlobe (USA) (Satellite Imagery, Geospatial Data)

List of suppliers who provide raw materials and components for the remote sensing technology market:

-

3M Company (USA)

-

Corning Incorporated (USA)

-

Teledyne Technologies (USA)

-

Vishay Intertechnology (USA)

-

Analog Devices (USA)

-

STMicroelectronics (Switzerland)

-

Honeywell International Inc. (USA)

-

Rohm Semiconductor (Japan)

-

Flir Systems (USA)

-

L3 Technologies (USA)

-

Raytheon Technologies (USA)

-

Northrop Grumman (USA)

-

Thales Group (France)

-

NXP Semiconductors (Netherlands)

-

Leica Microsystems (Germany)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 21.65 Billion |

| Market Size by 2032 | USD 51.04 Billion |

| CAGR | CAGR of 11.32% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Active Sensing, Passive Sensing) • By Platform (Satellite, Aerial Systems) • By Application (Agriculture & Living Resources, Military & Intelligence, Disaster Management, Infrastructure, Weather, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Maxar Technologies (USA), Esri (USA), General Dynamics Mission Systems, Inc. (USA), Hexagon AB (Sweden), Lockheed Martin Corporation (USA), Orbital Insight (USA), Planet Labs PBC (USA), Northrop Grumman Corporation (USA), General Dynamics Corp. (USA), Raytheon Corporation (USA), Honeywell Technology Solutions Inc. (USA), ITT Corp. (USA), Lumasense Technologies, Inc. (USA), Thales Group (France), Leica Geosystems Holdings AG (Switzerland), DigitalGlobe (USA). |